You can start your trading journey at Wildfunded in a few simple steps:

1- Choose your Plan

Subscribe using our Signup Form.

2- Pay for the Plan

You can pay your subscription fee using any major Debit Card/Credit Card.

3- Get your Wildfunded Dashboard

Upon completion of your payment, you will promptly receive an email containing the login credentials for your exclusive Wildfunded Member’s Dashboard and Data Feed Provider.

To trade with Wildfunded, you will need the following:

Data Feed provider

Trading Software

Market data is provided by the CME (Chicago Mercantile Exchange). The primary purpose of a market data feed provider for the futures market is to provide traders with fast and reliable market data, allowing them to make informed trading decisions in the futures market.

We provide you a Free License of our recommended platform Blackarrow, one of the most recognized platforms in the futures market.

During the evaluation phase, a non-professional trader will get the following data Level I (Top of the book) for free: CME, CBOT, COMEX, NYMEX.

1. Download (click here). Blackarrow Free License Profesional Platform.

2. Once you have completed the installation of Blackarrow, you can log in using the credentials sent to you in the payment confirmation email.

3. Use the Wildfunded Server Conection in Blackarrow.

4. Select your account, create your workspace, and you’re ready to start trading with Wildfunded.

Due to the resources you will need, we recommend that you use a PC with the following minimum specifications:

- Dual Core CPU (2.5 GHz or higher).

- 4 GB RAM (or higher).

- 2 GB free space (or higher).

- 1280 x 1024 monitor resolution (or higher).

Wildfunded does not currently support business accounts.

Traders may only register as individuals.

Once you receive our email, you’re all set to begin your exciting journey with Wildfunded.

The Daily Loss Limit is a specified amount that you, as the trader, can lose in a day, either on your total asset amount or on a single trade. This trading rule allows you to take responsibility for your trades, teaching you to understand the risks and to trade strategically and disciplined while understanding and closely following the money management rules.

Wildfunded sets daily loss limits based on the size of the trading account to ensure realistic risk management for individual traders. Your account will be closely monitored each trading day to determine whether you have reached or exceeded your daily loss limit. The limit can be exceeded after closing a trade, or if the limit is reached during an open trade, the account will automatically be disqualified.

All fees and commissions svon your profile are taken into account when calculating your daily losses. So, it is essential that you keep track of your assets on the trading platform and do not allow your losses to exceed this limit. If you exceed your daily loss limit, open trade positions will be closed, and your account will be automatically deactivated.

Drawdown is a term used in finance to describe the decrease in the return curve from the highest to the lowest point. It represents the worst series of losses and helps traders understand how much they can afford to lose and which strategies to use to reach their trading goals.

In trading, drawdown is a term used to determine the maximum amount a trader can lose. It also allows us to understand the techniques utilized by each trader, the fluctuations in their account, and how they aim to achieve their end goal.

End of Day Drawdown (EOD):

“EOD Trailing Drawdown” is a term used in trading to describe a method of measuring drawdown, which refers to the peak-to-trough decline in the value of a trading account or investment portfolio. Example of EOD Trailing Drawdown: If you start the day at $50,000, your trailing drawdown will only increase if you end the day above the $50,000 mark. At the end of the day, your minimum account balance will increase. Otherwise, the minimum balance will remain the same.

During the evaluation phase of your trading career, your permitted Drawdown will trail with your account balance, but it will only be calculated when your account balance reaches a new peak at the end of each trading day.

This calculation considers only the profits that you have realized until that point while disregarding any unrealized profits that you may have been targeting throughout the day.

However, your account will be liquidated if its current balance exceeds the value of your drawdown limit.

You can now easily copy trades across your Evaluation and Wild Live Accounts. There is maximun of 3 Live accounts per user. With this, you can quickly and effortlessly replicate your best strategies between your active accounts, helping you maximize consistency and efficiency in your trading.

Device Sharing & Copy-Trading other Traders:

Each individual trader is required to maintain their own individual trading activity. Meaning, entering, exiting and cancelling their own trade executions. Traders are not permitted to copy trade one another by entering, exiting or cancelling trade positions.

Each individual trader may not use the same device (tablet, phone or computer) as used by another trader. If this is not respected, then it could lead to permament restrictions from using our services

Trades can be placed starting at 6:00 PM EST at the Globex Open and can be held through until the 4:10 PM EST NY session close. At Wildfunded, positions will be closed for you during regular trading days at 4:10 PM EST. So, you need not worry about breaching the rule.

Make sure that you don’t force a trade multiple times on the market after 4:10 PM EST, as this will sometimes cause the order to go through and disqualify your trading account.

Can I trade the Globex Opening at 06:00pm EST?

Yes, you can trade between the specified times. However, please note that even if you are at the sim funded or sim evaluation stages, we do not recommend trading when the markets are said to be illiquid. This can cause issues with the position.

Illiquid hours are allowed to trade, but at the traders own discretion. This is also applicable for holiday trading hours as well.

Holiday Hour Trading:

During holiday trading hours, auto-liquidation will not occur at the half-time market close, and the trader is responsible for closing the positions.

Please note the times that you’re allowed to trade.

Failure to close the positions before the market closes will result in breaching of the account.

Overnight Trading is not allowed in Wildfunded:

Our funding programs are designed for Daytraders. All trades must be opened and closed on the same day.

Wildfunded commissions are regulated to ensure that everything is fair to both our customers and our company. Please see the table below for our commission rate.

Mini Contract – $5 roundtrip

Micro Contract – $0.6 per side or $1.20 roundtrip

The maximum number of contracts or position sizes you may trade at any time is predetermined for your account according to your chosen program. For example, if your maximum position size is 5, you can only trade up to 5 contracts in any of the available markets.

Please be aware of the contract limit on your chosen program to ensure that you do not exceed it, as doing so violates Wildfunded’s trading rules.

Our programs allow the following numbers of contracts to be traded at one time:

Strictly No VPNs or Proxies Allowed:

At Wildfunded, we require that every user accesses our platform using their real IP address. The use of VPNs, proxies, or any other tools that mask or alter your real IP address while using our services is strictly prohibited. This rule applies without exception to ensure security, fairness, and compliance with our platform’s policies.

Why Is VPN/Proxy Use Prohibited?

Security & Compliance: Requiring everyone to access our platform using their real IP addresses helps us prevent fraudulent activities.

Fair Trading Environment: Using your actual location ensures that all trading activities are legitimate helps maintain the integrity of our trading system.

Violation of KYC & Anti-Money Laundering Policies: Concealing your IP can lead to breaches in regulatory standards. The use of a VPN or proxy is considered a direct violation of Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, as it obscures user identity and location, which are critical for compliance.

Enforcement & Consequences:

All IPs are recorded each time you access our platform. These logs must reflect your real location. If we detect VPN or proxy usage on your account, the following actions will be taken:

Immediate account suspension while we review the violation.

Your account will be terminated and permanently banned without prior notice.

Any attempt to bypass our security measures will be flagged as a potential fraudulent activity, leading to severe restrictions on your account.

Forfeiture of funds or privileges associated with the account.

Legal action, which could include reporting to regulatory authorities, among other options.

How to Avoid Violations:

Always use your real IP address and connect from your actual physical location when accessing our platform.

Avoid using any software or tools that mask, alter, or hide your online identity.

If you are in a restricted region, please note that our services are not available in these areas due to partner restrictions. Any attempt to bypass these restrictions using a VPN or proxy will result in an immediate ban.

Consequences of Prohibited Actions:

Engaging in hedging or other prohibited actions can result in account termination, forfeiture of profits, and permanent banning from the platform, even during the Evaluation phase. Wildfunded is committed to maintaining a fair trading environment and takes strict measures to maintain that standard.

Hedging is a trading strategy where you simultaneously hold both long and short positions in the same, underlying, or correlated instruments. While it’s often used to reduce risk, it’s strictly prohibited on Wildfunded due to its potential for abuse and manipulation.

Why is Hedging Prohibited?

Risk Manipulation: Hedging can artificially lower the risk in trades, allowing traders to use Wildfunded’s capital without exposure to actual market risk.

Violation of Trading Ethics: By masking your true trading intentions and performance, hedging can violate the ethical standards we expect from our traders.

Compliance with Market Regulations: Regulatory bodies like the CME prohibit hedging practices. To ensure compliance, Wildfunded maintains a strict no-hedging policy.

Should you be found involved in hedging or participating in any dubious activities, Wilfunded will immediately close all your accounts. You will lose any profits earned, and there’s a possibility of facing a permanent ban from the platform. These actions are enforced to maintain a level playing field for all participants.

We are committed to maintaining a clear and ethical trading atmosphere. It is mandatory for all traders to comply with these policies and maintain the highest level of integrity. Any attempts to evade these regulations will have serious repercussions, including forfeiting your trading account and privileges.

Additional Prohibited Actions for Traders:

Micro scalping: Micro scalp trading involves executing numerous quick trades for small profits. It is strictly forbidden to engage in micro scalping operations shorter than 10 seconds during the opening (5 minutes before and after) of the US market opening at 8:30 AM CST (Chicago). Doing so will result in the termination of the account.

Copy trading: Automated replication of other traders’ trades is banned.

Algorithmic trading: The use of computer programs for automated trading is prohibited.

Intentional fraud: Any deliberate deception or manipulation is strictly forbidden.

Creating multiple profiles: Opening multiple trading accounts under the same name or identity is forbidden.

Inactivity: Failure to trade regularly, with no single trading activity in a week (7 days), is prohibited unless a temporary suspension is approved. Only for Live account.

In the trading world, we value well-defined techniques and strategic trading to achieve constant results. However, sometimes it takes effort to avoid the temptation of playing big to win big. So, to help our community overcome this hurdle, we introduced the Maintain Consistency Rule.

Consistency is vital to successful trading. By adhering to your established methods, you can effectively gauge your capacity to generate profits and manage risks. We, as traders, know all too well the importance of having the patience, the restraint, and the skill to produce consistent gains.

Evaluation Programs:

The basic rule you have to follow is not to exceed 50% of the target with 1 trade in a single day. Then you have to make at least 2 profit days that do not exceed 50% of the total profit. We reward traders who make a calculated trading, and this rule prevents some participants from looking for crazy profit days.

Live Accounts:

Our new rule stipulates that your Highest Daily PnL can only account for up to 25% of your total profits. You must set a daily profit goal and adhere to it religiously to comply with and qualify for our Payout Policy. Don’t worry, going over 25% of profits per day will not deactivate your account. Instead, you will only need to maintain consistent earnings in the upcoming trading days to balance out your overall profit. Through this, you can make your highest trading profit qualify as 25%.

Maintaining consistency can be done without trading daily. You can schedule your trades as often or as seldom as you’d like without sacrificing your valuable time.

Have you violated any of the rules? No big deal; you have the option to reset your account balance by paying a flat reset fee. Once you finalize the purchase, the reset will be processed immediately, and you will be notified by email.

What is a Reset?

The Reset service updates the initial balance of your evaluation account so you can continue trading in your active subscription. All previous results will not be counted. However, the Reset service does not reset the due date of your subscription. Your subscription is automatically renewed every 30 days unless you cancel it yourself.

How to reset:

1. Log in to your account and navigate to your dashboard.

2. Click on the reset tab.

3. Follow the prompts to complete the payment for the reset.

Reset Fee:

You can see the rates on the main page when you go to select one of our programs.

To qualify for a Wild Live Account, you have to reach the profit target that corresponds to the plan you have purchased while making sure to respect all the rules. You need minimum 2 days of trading to complete the 50% consistency rule.

However, there is no maximum of days required to validate your account as long as the rules are respected. The basic rule you have to follow is not to exceed 50% of the target with 1 trade in a single day. Then you have to make at least 2 profit days that do not exceed 50% of the total profit.

Example:

- Target $2,500 – You pass the test with two positive days of $1,250 each.

- If one profit day is $1,400 and the other $1,100 you are going to reach the target but the test will not be considered valid. You must make an extra profit of $300 to comply with the consistency rule.

If the monthly subscription is due but you haven’t reached the profit target and and you have not hit the drawdown, you will get to keep your balance and continue trading in the same account.

During Wildfunded Programs, participants are permitted to trade Futures products only. Trading of Stocks, Options, Forex, Cryptocurrency and CFD’s are not permitted nor available in our program or platforms. A non-professional trader will get the following CME Group data (top of the book) for free:

CME, CBOT, NYMEX, COMEX.

To maintain fairness, transparency, and compliance with our policies, we strictly prohibit multiple users from operating accounts within the same household or under the same IP address. This rule applies without exception.

Why This Policy Exists?

This policy ensures the integrity of our platform by preventing:

- Unfair Advantage: Preventing coordinated activities or manipulation that could create an imbalance, disadvantaging other users.

- Security Risks: Reducing the risk of shared credentials and account compromises.

How It Works?

- Our system monitors and flags accounts using the same IP address or displaying similar activity patterns.

- Accounts identified as operating from the same household will be reviewed and may be restricted.

What Happens if This Policy is Violated?

- Accounts found in violation will be immediately restricted or suspended.

- Repeated violations may result in permanent account termination and disqualification from future participation.

In the realm of automated trading, Wildfunded enforces stringent guidelines to maintain a fair and transparent trading environment:

● Automated Scalping: The platform restricts the use of automated systems designed for ultra-high-frequency scalping.

● Automated Tools: The use of AI, bots, and other automated trading mechanisms is strictly prohibited across all account types. This includes Third Party Automation. More details on Third Party Automation below.

● Semi-Automated Trading: This is permissible under the condition that traders actively monitor, manually manage, and understand the system and semi-automation’s purpose.

● Automated Behavior: Any form of hands-off, continuous day and night trading, or any other type of full automation is strictly forbidden.

Third party automation” in futures trading refers to a situation where a trader uses a separate, external software or service provider to automate their futures trading strategies, rather than relying solely on the trading platform provided by their broker; essentially, a third-party company manages the execution of their trading orders based on predefined rules and parameters set by the trader.

It is a requirement that all accounts participating in our challenges are exclusively traded by the account owner without any alterations once a phase has been successfully completed. Failure to comply with this rule will be considered a breach of the account.

To maintain the integrity of the challenge and ensure a fair evaluation of your trading skills, it is crucial that you refrain from making any modifications or allowing others to trade on your behalf once you have progressed to a new stage. Only the account owner should be actively involved in trading activities for the respective accounts and simulated challenges.

The use of shared devices is strictly forbidden and may result in a breach and/or account failure. E.g.: using the same PC or Phone as your partner to make use of our services and trading accounts.

By adhering to this guideline, you will demonstrate your commitment to the challenge and the evaluation process. Please remember that any breach of this rule may result in account failure.

Wildfunded emphasizes ethical trading practices and order management to ensure a stable and reliable trading environment.

● Order Placement: Simultaneously placing multiple limit orders at the same price to manipulate order fills is prohibited.

● Gapped or Illiquid Market Trading: Initiating trades to profit from isolated fills in these markets is not allowed.

● Slippage and Bracket Usage: Exploiting the absence of slippage and utilizing tight brackets to gain from favorable fills are not permitted.

● Tier 1 Economic Data Trading: Engaging in trades during tier 1 economic data releases is restricted.

● Compliance with CME Group Rules: All trading activities must adhere to CME Group’s rules and regulations.

● Collaborative Trading: Collaborating with others to execute identical or opposite strategies across unconnected accounts is prohibited.

At Wildfunded, we deeply value your adherence to these guidelines as we collectively navigate towards a prosperous trading future. Our policies are crafted to protect traders and the firm, ensuring a viable and supportive platform for authentic trading skill development. We encourage all our traders to trade ethically, respecting the guidelines and the platform, to create a sustainable and profitable trading environment for all.

Microscalping is not allowed in Wildfunded. Microscalping is an aggressive form of scalping where traders execute trades that last only a few seconds and aim for tiny profit margins, often just a few ticks or points. The goal is to accumulate small gains over many trades, which can add up to significant profits if done correctly.

Wildfunded, through its Risk Department and trading experts, reserves the right to assess if a user’s actions qualify as micro-scalping and to cancel the account if necessary.

Trades Duration:

You should always perform trades lasting more than 10 seconds duration and achieve profits of at least 5 points. If a large number of trades are below these parameters our team reserves the right to consider at any time if the Trader is performing microscalping strategies. In the case of detecting this type of practice, your account will be closed or you will not be eligible to withdraw profits.

Microscaling during News Forbidden:

This type of practice is strictly forbidden 5 minutes before and after market opening and economic news. In other words, there is a 10-minute period of high volatility at the opening and during the news when this type of trading is prohibited.

Why Microscalping Can Be Problematic?

This strategy lead to significant losses and can be problematic in certain trading environments due to its dependency on perfect market conditions and low slippage. Be careful when performing the following type of operations, your account could be blocked:

- Short Trade Duration: Trades are typically held for less than 10 seconds.

- Minimal Profit Targets: Aiming for profit margins of less than 5 points or just a few ticks.

- High Trade Frequency: Executing a large number of trades within a short timeframe.

- Tight Stops and Limits: Using very tight stop-loss and take-profit orders.

While both microscalping and regular scalping aim to profit from small price movements, they differ in their execution and risk profiles:

Regular Scalping: Involves holding trades for a slightly longer period, typically a few minutes, and aiming for larger profit margins, such as 5-10 points.

Microscalping: Trades last only a few seconds and target very small profits, often less than 5 points. This strategy relies heavily on low slippage and perfect market conditions, making it less reliable in real-world trading scenarios.

Market Conditions: Microscalping works best in low volatility and highly liquid markets, which are not always available.

Slippage: The strategy’s success heavily depends on minimal slippage, which is not guaranteed, especially in live trading environments.

Order Execution: In a live environment, order execution may not be as quick and efficient as in simulated environments, leading to losses.

Sustainability: While it can be profitable in the short term, microscalping often leads to inconsistent results and can quickly burn through trading accounts.

Understanding the nuances of microscalping is crucial for traders, especially those in simulated or prop trading environments, where such strategies may be restricted to ensure long-term profitability and sustainability.

By joining Wildfunded, you agree to follow our trading rules as you aim to reach your target trading goals. Any violation of our trading rules disqualifies your account. You may familiarize yourself with our rules and trade responsibly to avoid losing your account.

If your challenge account is deactivated, you may purchase a reset.

You can start your trading journey at Wildfunded in in a few simple steps:

1- Choose your Plan

Subscribe using our Signup Form.

2- Pay for the Plan

You can pay your subscription fee using any major Debit Card/Credit Card or Cryptocurrency.

3- Get your Wildfunded Dashboard

Upon completion of your payment, we will promptly deliver an email to your inbox containing the login credentials for your exclusiveWildfundedr Member’s Dashboard and Data Feed Provider.

1. Registration

Register on our platform and choose a subscription through our Signup Form. You may purchase your evaluation pack using any major credit/debit card or cryptocurrency.

2. Platforms Connection

Download and Blackarrow. We give you free license key. Just send us a message, and our Support team will provide you with a license key.

3. Evaluation Phase

You can trade according to your strategies at this stage, following the Wildfunded guidelines set in your chosen plan.

Once you’ve reached your target, you will need to submit your account for validation, after which our team will review your account.

4. Be a Wildfunded Trader in a Live Account.

Once your account is validated, and you complete your requirements, you may start earning money trading on our accounts.

Wildfunded is a Funding Company based in Dubai, United Arab Emirates. Created by traders for traders, Wildfunded seeks to find professional traders through assessments called challenges/programs. All traders of Wildfunded operate in a paper trading environment, which means you are trading in a simulated futures trading environment. Our traders are remunerated based on the performance in the paper trading accounts, and the company bears a substantial portion of the risk.

Anyone over the age of 18 can become a trader by participating in the challenges We do not require qualifications or previous experience, but we reject anyone with links to financial crime or terrorism. We also reject those who have violated our terms and conditions.

During Wildfunded Programs, participants are permitted to trade Futures products only. Trading of Stocks, Options, Forex, Cryptocurrency and CFD’s are not permitted nor available in our program or platforms. A non-professional trader will get the following CME Group data (top of the book) for free:

CME, CBOT, COMEX, NYMEX

We strive to provide our services to traders across the globe. However, due to regulatory and compliance reasons, certain countries are restricted from accessing our platform. This article provides an updated list of restricted countries where Wildfunded services are not available.

Wildfunded does not provide services in the following locations:

Afghanistan, Central African Rep, Congo (Brazzaville), Guinea, Haiti, Iran, Iraq, Libya, Madagascar, Mali, Myanmar (Burma), Nigeria, North Korea, Pakistan, Russian Federation, Somalia, South Sudan, Sudan, Syria, Taiwan, Trinidad and Tobago, Uganda, Ukraine, Venezuela, Vietnam, Yemen.

We are temporarily unable to provide our offerings in the following states and territories: Minnesota, South Carolina, Guam, Puerto Rico, U.S. Virgin Islands.

If you’re located in any of these areas, we regret that we cannot offer our services at this time. We are actively working to expand and improve our service availability and hope to include these regions in the future.

We are not a brokerage service. We work with regulated external liquidity providers that guarantee real market data in real time. The Futures market is highly regulated and guarantees that traders can perform their activity safely.

You can pay a challenge account using your Credit card (only in the account holder’s name).

Processing time & Fees may vary depending on the payment method and your financial institution.

All subscriptions made in Wildfunded are final.

Unless otherwise specified, each Subscription Term will automatically renew on every due date unless you have canceled your subscription before the expiration of the then-current Subscription Term. Your participation in, or failure to use, such purchased service does not entitle you to a refund.

No returns, refunds, or exchanges, partial or otherwise, for any reason. Once your order has been placed and your credit card billed or crypto payment processed, there are no returns or credits. You may not return the product and demand a refund, as you were supplied intellectual property as well.

Your use of the site, and any publications, presentations, financial trading information, pricing data, trade data, performance information, blogs, postings or other information, content, services, and materials contained in, accessed via, or described on the site is at your own risk. All such information, content, services, and materials are provided on an “as is” and “as available” basis. To the full extent permissible by applicable law, Wildfunded makes no and hereby disclaims all representations or warranties of any kind, expressed or implied, as to the availability, operations, and use of the site or the information, content, materials, or services on or accessed via the site.

Any purchases that result in a chargeback or payment dispute will result in Wildfunded immediately deactivating your membership. Your username will be permanently banned from our database of authorized users.

Any chargeback initiated by you will be investigated to the fullest extent and you will no longer be able to purchase any services from our company. Any additional purchases will be refunded immediately.

In no event shall Wildfunded be liable to you or any third party for damages of any kind arising out of the use, access to, reliance on, inability to use, or improper use of the site, any information, content, materials, or services available on the site.

No, you cannot. The terms of service clearly state that the account should be controlled and traded by the person who purchased the evaluation. This applies to payments as well. If you use someone else’s card to purchase an account, your account will be terminated, and you will not be eligible for any refunds or payouts – this includes a friend or family member’s card. This is considered fraudulent behavior.

Things to Ensure Before Purchasing via Cards:

- The card’s billing address and the provided address must match.

- The name on the card must match the name registered with us.

- Forex cards and prepaid card payments are not accepted.

- Fraudulent activity with the card will not be tolerated.

- Chargebacks and other manipulative practices will not be tolerated.

Note: If any of the above guidelines are breached, even if you are in the sim-funded stage and making profits, your account will be revoked and you will be banned from trading with Wildfunded.

Wildfunded has a 24/7 multilingual service. Customer service hours may vary due to workload but we will give you an answer in less than 48 hours. If you want you can leave your message in the contact tab. If you prefer, you can send us an email with your questions to support@wildfunded.com. We will be glad to help you.

Wild funded has 3 types of funding accounts (BEAST, WARRIOR, DIRECT):

You can start by choosing any of our Evaluation Program (BEAST,WARRIOR) and put your skills into practice or you have the option to choose a Direct Account. Wild Direct Accounts give you the opportunity to trade directly on a live account without passing an exam.

Navigating the evaluation journey with Wildfunded is a structured and rewarding process. It’s meticulously designed to not only assess your trading acumen but also to prepare you for real-world trading scenarios. Here’s a comprehensive guide on how you can progress through the evaluation, what to expect at each stage, and how to ascend to the subsequent levels.

- Evaluation Program: This stage is primarily to assess if you possess the necessary skills to trade effectively. You’re provided a virtual account with a specific balance. To succeed, you must meet profit objectives and stay within the rules. The emphasis here is on risk management, achieving consistent profits, and adhering to the trading rules.

- Live Funded Account: The primary goal here is to demonstrate consistency in your trading over time and to take payouts as per the payout policy. While profitability is crucial, the emphasis is also on risk management and demonstrating a consistent trading strategy over time.

Consistency is key. It’s not just about hitting profit targets but doing so consistently over time. Wildfunded evaluation process is both rigorous and rewarding. By the time traders reach the live funded account stage, they are well-equipped with the skills, discipline, and strategies to succeed in the real world of trading. Each stage is a learning opportunity, making the journey both challenging and fulfilling.

At Wildfunded, we believe in providing traders with a clear path to success. A significant part of this journey involves understanding the evaluation parameters that guide your trading experience. These parameters are not just arbitrary rules; they are designed based on years of market experience and are aimed at fostering disciplined and profitable trading habits.

Profit Target: This is the predetermined profit amount you aim to achieve within the evaluation period. It serves as a benchmark for your trading success.

Maximum Drawdown: This is the maximum allowable loss from the peak of your account balance. It’s a safety net, ensuring that traders don’t risk too much capital.

Daily Loss Limit: This parameter sets a cap on how much you can lose in a single trading day. It’s designed to prevent spiraling losses on particularly volatile days.

EOD (End of Day) Drawdown: This refers to the drawdown that is pegged to your positive account performance and is adjusted at the end of the trading day. If you increase your profit by $1.00, then your minimum account balance will also rise by $1.00. This mechanism ensures that traders are rewarded for positive performance by granting them protection against potential future losses.

Consistency Rule: This rule ensures that traders don’t swing wildly in their trading sizes or strategies. It promotes steady and consistent trading habits.

- Minimum Trading Days: Some evaluations require traders to trade for a minimum number of days to ensure they are genuinely engaged and not just taking wild risks hoping for a lucky break.

The evaluation parameters at Wildfunded are not just rules but guiding principles designed to lead you into a disciplined and successful trader. By understanding and respecting these parameters, you set yourself up for a rewarding trading journey with Wildfunded .

A Live Account at Wildfunded is an active trading account where traders can trade with actual funds after successfully passing the evaluation phase. To access this account, traders must show their ability to manage risk, achieve profit targets, and follow the platform’s established rules during the evaluation phase. On this account, traders can withdraw their earnings according to the platform’s payout policy and must maintain consistent performance in their trades.

A Direct Account at Wildfunded allows traders to start trading with actual funds immediately, without needing to go through the evaluation phase. Traders can begin trading on a live account right away, but they still need to follow the platform’s rules, such as risk management and profit targets. It offers a quicker path to live trading for those who prefer to skip the evaluation process.

These accounts will follow the same rules as the Evaluation Accounts, except for the Maintain Consistency Rule of 25%.

We designed the Live Account for long-term relationships, opening the doors for our community to future opportunities and offers from our partners.

If you violate the trading rules, the Administrator will deactivate your Live Account.

After completing the required actions for your KYC verification and contract signing, the next step is to pay the activation fee.

If the system detects the activation fee as unpaid after your account completes KYC and contract signing, you’ll get reminders via email to ensure you don’t miss the payment.

Please note that the activation fee must be paid within thirty (30) days to avoid account forfeiture.

There is no monthly subscription fee on Live Accounts.

To activate your Live Account, a one-time non-refundable Activation Fee is required.

The one-time activation fee must be paid before you start trading with your Live Account. The fee is $129 for BEAST accounts.

After completing your KYC verification and signing the contract, you’ll have thirty (30) days to pay the activation fee.

This rule applies exclusively to Direct & Live accounts.

To keep your account active, you must make at least one trade every 7 days.

Not trading for 7 consecutive days is considered a reason for account disqualification.

This rule, however, does not apply to Beast and Warrior accounts. During the evaluation phase, there is no minimum number of trading days nor a time limit to progress, you can trade at your own pace. Please note that the monthly subscription will remain active throughout this period.

Consistency in contract usage:

Adjustments to contracts are allowed to adapt to the market, but not for:

- “All-in” strategies

- Count the day as traded.

This ensures that traders operate with consistent, planned volume, reflecting a realistic market strategy.

Examples:

- If you are trading regular with 1 or 2 contracts and you make a trade with 8 contracts, will be considered gambling.

- If you are trading 1 o 2 NQ contracts regular and you make a MNQ 1 contract to count the day as traded, will be considered you want to count the day as traded.

Risk vs. Return:

A trade must not have an expected loss greater than 5 times the Average of the winning trades.

This promotes consistency by balancing risk with potential profitability.

Examples:

- If you make: +$200, +$300, +$400 (Average = $300), you cant have a loss bigger than -$1,500 (300×5).

- If you make: +$200, +$400, +$600 (Average = $400), you can lose up to $2,000 (400×5), not more.

- If you make: +$100, +$200, +$300 (Average = $200), and you have a loss > $1,000 (200×5), it will be considered Gambling.

In these cases, we will consider that you are gambling or trading just to keep the account active, and you will lose, the trading day, your account will be blocked, or you will not be able to request withdrawals.

These rules have been created to help traders maintain consistency in their trading and to prevent traders with gambler-like behavior from operating on Wildfunded.

We want to reward traders for doing their job well, not for engaging in unethical behavior.

Unlike our Evaluation accounts, you can only have up to three (3) active Live Accounts at a time.

In light of our latest copy trading policy, the limitation of Live Accounts per user can help mitigate the risks of account deactivation.

At Wildfunded, we prioritize the security and compliance of our services. To ensure this, we have established Know Your Customer (KYC) and Anti-Money Laundering (AML) policies that are mandatory for all users who request payouts.

When is KYC Required?

It is a prerequisite to request a payout with us.

KYC is conducted once per person, and only one profile can be verified per individual.

Necessary Documents for Identity Verification:

To verify your identity, you will need to provide the following documents:

Proof of Identity (PoI):

A live picture of your identity document. Acceptable documents include:

Passport

National Identity Card

Driving License

Live Selfie/Recording:

A live selfie or recording showing your face, matching the person in the PoI document.

Proof of Address (PoA):

You must provide one of the following documents, which cannot be older than 3 months:

Bank Statement

Utility Bill for gas, electricity, water, internet, etc., linked to your property.

Government-Issued Correspondence: Letters from a recognized public authority or public servant.

Current Lease Agreement: Must include signatures of both the landlord and the tenant.

Credit Card Statement

Employer’s Certificate: For proof of residence.

House Purchase Deed

Alternative Proof of Address Examples:

If the above documents are not available, you may use one of the following as long as they contain your full address:

Passport

Identity Card

Driving License

Note: The document used for Proof of Address cannot be the same as the one used for Proof of Identity.

In some cases, documents listed above might not be accepted. If your document is declined, kindly attempt completing the application with a different Document.

Anti-Money Laundering (AML) Screening:

We are committed to preventing money laundering and terrorist financing. As part of our compliance with AML regulations, all applicants are required to undergo an automated AML screening process.

This screening helps us identify and mitigate potential risks associated with money laundering activities, such as:

Global watchlists and sanctions lists, including OFAC, UN, HMT, EU, DFAT and more

Politically Exposed Persons (PEP)

Adverse Media

Restricted Countries:

It’s important to note that we are unable to provide services in certain countries due to sanctions, embargoes, and/or restrictions from our platforms, brokers, and/or partners.

Countries with high fraud risk, such as those with significant credit card fraud, identity theft, and financial scams, are also restricted.

Anyone with citizenship or residency in a country on OFAC’s Sanctioned Countries list, or those restricted by our partners, are not eligible to open an account at Wildfunded

Disclaimer:

We use a third-party KYC/AML processor to verify the provided documents and rely on their expertise in this matter. If, for any reason, your profile cannot be verified by them, we must comply with their decision and cannot alter it. Customers must be of legal age to engage in trading activities in their respective jurisdictions. All of the above is strictly enforced and adhered to.

Thank you for your cooperation and understanding.

At Wildfunded, we’re committed to transparency and supporting your success. Our payout policy ensures a fair balance between your goals and account security. Here’s how it works:

Flexible & Fast Payouts:

▪︎ Request payouts every 5 winning days (not consecutive days).

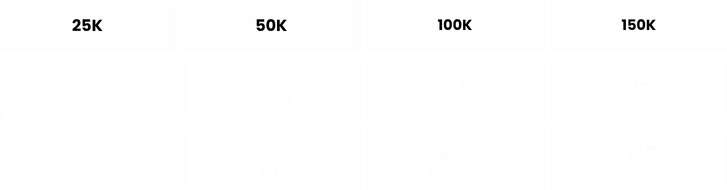

▪︎ To be considered a winning day, a trader must achieve the following daily profit amounts in his account:

Consistency Rule:

You must also adhere to a 25% consistency rule. This means that your highest daily profit cannot exceed 25% of the final account balance.

▪︎ Example 1: You are trading a $50,000 Live Account and you make 5 days of $250 profit (non-consecutive). You have a stop loss day of $250. Your account now has a balance of $1,000 in profit. You can now request a withdrawal of $500.

▪︎ Example 2: You are trading a $50,000 Live Account and you make 4 days of $250 profit and one $500 profit day (non-consecutive). You have a stop loss day of $250. Your account now has a balance of $1,250 in profit. You cannot request a withdrawal because the $500 profit equals 40% of $1,250 and does not meet the consistency rule.

Minimum withdrawal amounts:

The minimum withdrawal amount is equivalent to 1% of your initial account balance.

Payouts are processed within 1–3 business days.

Maximum withdrawal amounts:

Our withdrawal policies are designed to be able to pay Traders without any problems. We want to reward Traders who do their job well and deserve a reward. That’s why we strive to design systems that benefit participants while protecting a long-term, prosperous relationship. Withdrawals are calculated according to the size of your account.

Tiered payout limits increase with each successful payout:

Your withdrawal capacity is limited also on a monthly basis:

If you are operating a live account and have made a $10,000 profit on your account you will also be able to withdraw your profits. The amount will be distributed monthly according to the monthly limits.

▪︎ Example: You are trading a $100,000 account and have a $10,000 total profit balance. You can withdraw your profits in 3 months: 1st month – $4,000/ 2nd month – $4,000/ 3rd month – $2,000.

Unlock limits on your withdrawals:

At Wildfunded, the withdrawal system is organised into two phases, designed to allow traders to access their profits progressively and sustainably.

-Phase 1 – 50% Withdrawal

Once you have accumulated 5 non-consecutive profitable days, you may request a withdrawal of 50% of the available balance, respecting the minimum and maximum withdrawal limits set for your account.

The remaining 50% will stay in the account as an operational buffer, allowing you to continue trading, developing your strategy and demonstrating consistency whilst your account grows safely.

After each withdrawal, you must once again accumulate 5 non-consecutive profitable days to qualify for the next withdrawal. This ensures a balanced, stable and sustainable withdrawal system.

-Phase 2 – 80/20 Withdrawal

After reaching a total of 30 profitable days, you will automatically move into the second phase. At this stage, an operational buffer is no longer required. Thanks to the consistency and discipline demonstrated to reach Phase 2, and as recognition of your performance, you will gain access to withdraw your total profits under the 80% trader / 20% WildFunded split.

- In this phase, you may withdraw 80% of your total profits, provided you do not exceed the maximum withdrawal limit for your account.

- You are no longer required to accumulate profitable days before requesting a withdrawal. This means you can access your funds whenever you wish, with full flexibility and no waiting period.

Example:

If the account balance is $53,000 and the trader requests a withdrawal of $1,000; the balance will be reduced to $52,000 and, according to the 80/20 split, the trader will receive $800.

The Wildfunded system is designed to reward consistency and discipline, ensuring that withdrawals reflect stable, responsible and performance-based trading results.

Closing Your Account Payouts:

If for any reason your account is blocked by the administrator and you have not violated any rule, you may receive 20% of your balance.

Recommended behavior:

If you have questions or need assistance, contact us by email to payouts@wildfunded.com.

We’re here to help you succeed every step of the way.

You can withrawal by a simple steps:

- Ensure you’ve reached passed your evaluation and reached payout eligibility on your sim Live funded account.

- Complete KYC on the Wildfunded dashboard.

- Submit your payout request via email to payouts@wildfunded.com.

- Ensure your request meets the minimum withdrawal amount.

Once your request is submitted:

- The payout request will be reviewed, which can take up to 1–3 business days.

- Once approved, you will receive an email to sign agreements with Wildfunded for payout.

- Upon signing your agreements, you will then shortly after receive your payout. We use Rise, which offers both bank transfer and cryptocurrency options.

- Payouts are managed Monday to Friday. You can check the list of countries where Rise is not available here: https://help.riseworks.io/en/articles/7198515-restricted-countries

If you have questions or need assistance, contact us by email to payouts@wildfunded.com.

We’re here to help you succeed every step of the way.

Step 1: Send us an email to support@wildfunded for Evaluation Review. Once you have successfully passed the evaluation, send an email to inform us that the test has been completed. This will trigger the review process for your account.

Step 2: Our team will check if your program has been successfully passed without violating any of the rules. If your evaluation is correct and you have not violated any rules, you will receive two separate emails:

* 1st email will contain the payment link for the activation fee.

* 2nd email will contain the contract you need to sign.

Complete both the payment and the contract as instructed in the emails.

Step 3: Send a confirmation email to support@wildfunded.com to inform us that you have completed both steps and expedite the procedures in the shortest possible time (payment and contract signing). We will then review everything to ensure it is all in order.

Step 4: Receive New Login Credentials. After confirming that everything is correct, you will receive a final email with your new credentials for the live account. You can then start trading with your new live account.

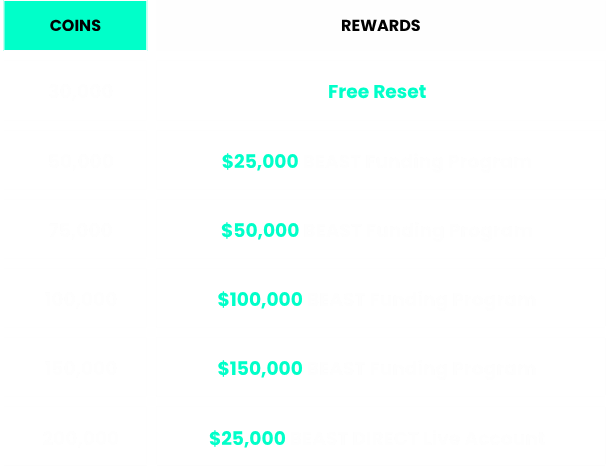

We want to reward our Traders for choosing Wildfunded. As you reach different goals, you will be rewarded with our Wildfunded Coins. Your progress through the levels is based on accumulated coins. All users are already linked to these rewards, so you don’t need to do anything. You can start earning them today by simply trading with us.

You will get Wildfunded Coins for every program you purchase on our platform. In addition, you will earn additional points for reaching various achievements. Passing a Funding Program, Withdraw money, Each Day you Trade, Profit Day, Green Week, even more points…

We’ll soon be adding even more achievements to unlock, so no matter where you are on your funded trading journey with us, you’ll always have a new goal to aim for!

Wildfunded Coins are versatile and can be instantly redeemed for a variety of rewards. Within your Wildfunded Coins you can convert points into credits and credits into free resets and free accounts. Then, as you advance through higher levels, you will receive level-specific credits and additional perks.

Please note that Wildfunded Coins are purchased per user. Coins from several users cannot be used together. Each user has his own bank of coins to use.

You can check our Wildfunded Coins page for more information.

At Wildfunded, we’ve meticulously crafted a rewards system tailored for our traders, designed to recognize various achievements.

Buying a New Funding Program:

Other achievements:

- Passing a Funding Program – The user will get the same Coins as by purchasing the passed test.

- A day of trading (every day you open an trade) – 10 Coins.

- Profit Day (day you end up winning) – 30 Coins.

- Green Week (full profit 5 week days) – 500 Coins.

- Withdraw Money (one dolar you withraw, one coin you earn) – $1,000 = 1,000 Coins.

- Reset = 2500 coins

Wildfunded Coins are redeemable for a variety of credits:

In order to redeem your points, please send us a email to rewards@wildfunded.com with the following information:

- Wildfunded ID and email.

- Total of Credit Coins you have.

- What rewards would you like to unlock with the coins.

Make sure you have the necessary balance to unlock your rewards. A support person will assist you with the entire process to redeem your coins.

The Affiliate program is open to any individual or company involved in the prop trading industry. This includes funded account reviewers, trading educators, blogs, forums, and other related sites. Affiliates can sign up via an application process which can be found on the Wildfunded dashboard.

Wildfunded affiliates must practice ethical marketing, provide accurate information, and avoid misleading or fraudulent activities. Any deception, misrepresentation, or manipulation will result in immediate termination and loss of commissions. All promotional content must be clear, honest, and compliant with our guidelines.

Paid advertising and pay-per-click ads are strictly prohibited by the Wildfunded Affiliate Program. This includes, but is not limited to, Google Ads, Facebook Ads, native advertising, paid endorsements, and any other paid promotions. Spam and/or illegal marketing is also strictly prohibited.

Wildfunded may terminate any affiliate for promotional violations, fraudulent activities, or other reasons deemed detrimental to the program. Upon termination, all rights and access will be revoked. Any pending commissions will be forfeited.

Wildfunded reserves the right to audit affiliate activity and ask for more information on how the affiliate is promoting their code/link. The relationship may be terminated if the information is not provided or the information provided is deemed inaccurate.

You can check our affiliates page for more information.

The Wildfunded Affiliate Program allows affiliates to earn 10% commission, on evaluation and reset fees from traders referred via their unique affiliate link or code. However, your affiliate commissions may increase until 14% based on the volume of referrals you bring to Wildfunded Affiliates can promote Wildfunded through their website, email lists, social media, and other marketing channels.

You can check our affiliates page for more information.

Anyone can participate in Wildfunded tournaments. We are committed to our community and want to offer exciting experiences that help our Traders reach their full potential and achieve rewards.

Participating in a Wildfunded Tournament is very simple. All you have to do is subscribe to the corresponding Tournament tab and follow the instructions that we will provide on our website.

Wildfunded Tournaments offer different rewards. You can win cash prizes, Funding Challenges, Invitations to Events, Trips, Meeting with other Traders and the Wildfunded Team, among others…